A meeting was held between Azerbaijan Credit Bureau and Azerbaijan Banks Association

On February 23, 2024, a meeting was held between Azerbaijan Credit Bureau (ACB) and Azerbaijan Banks Association (ABA) with the participation of banks.

In the meeting, detailed information was given about new services of ACB, as well as improvements in existing services, and detailed information was given about projects implemented by ACB and innovations implemented, taking into account the proposals of banks.

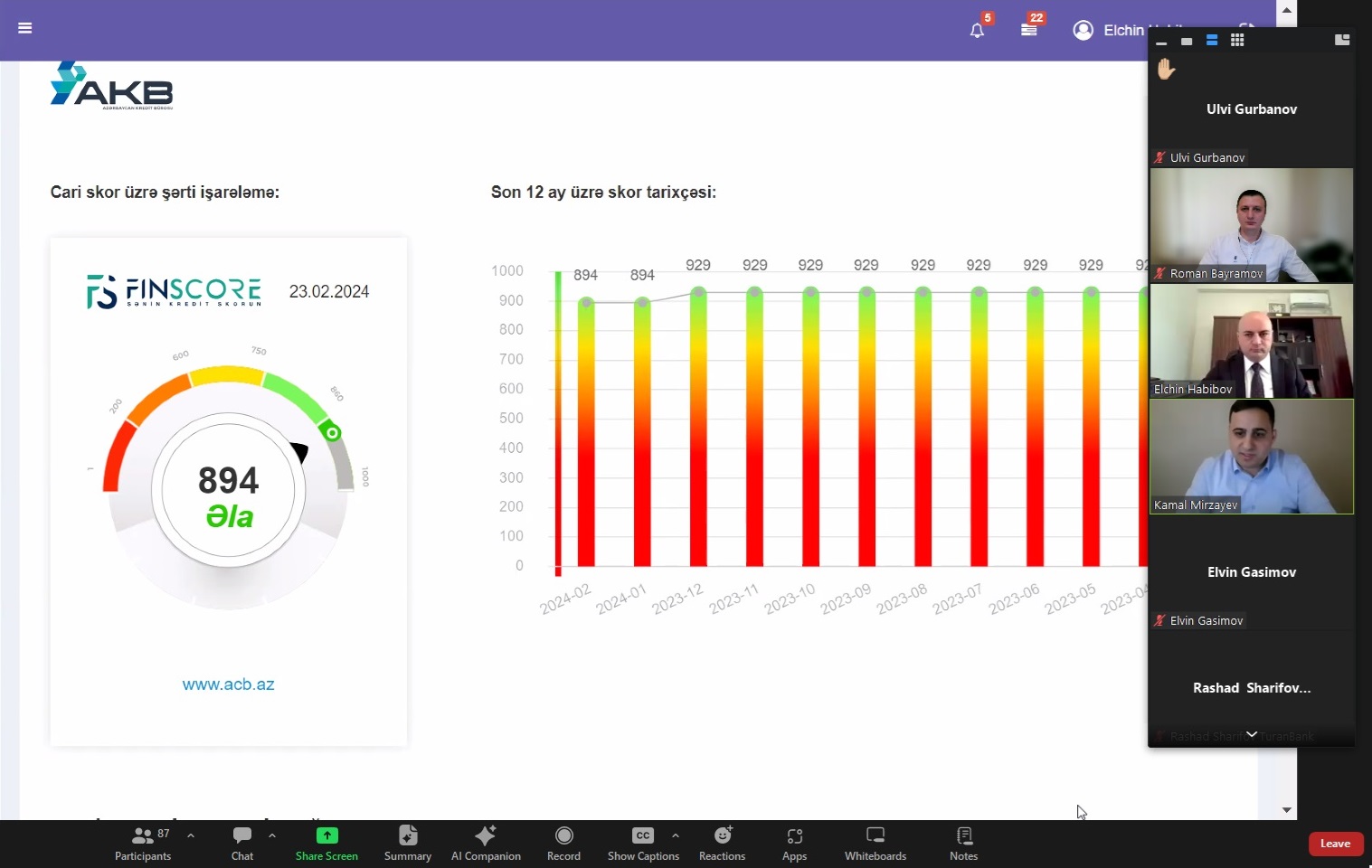

Firstly, a presentation to the participants about the updated "FinScore" service prepared by ACB together with the "Kredi Kayıt Bürosu" (KKB) of Turkey, with the involvement of ACB's partner banks, non-bank credit organizations, retail companies and other partners of the Bureau. During the presentation of the new model with a fairly high predictive power - 72.2 Gini coefficient, it was specially mentioned that, in addition to the current score, the 4 main criteria that most influence its formation, as well as the relevant person's last 12-month score history, were also presented.

Later, along with traditional services, ACB provided information on the alternative reports module for the information on mandatory obligations of individuals available in the database of state bodies, and provided the appropriate service for making credit decisions more accurate and correct for borrowers' financial discipline and solvency. importance in minimizing risks by identifying and thereby reducing information asymmetry.

The mentioned report contains the information related to the relevant obligations obtained from the databases of the state bodies named below:

- information from the Ministry of Justice of the Republic of Azerbaijan on legal cases regarding individuals, obligations determined by the execution and probation department, notarized debt contracts;

- Information on fines imposed on individuals from the General State Traffic Police Department of the Republic of Azerbaijan;

- Information on debt, property (confiscation) debt, social debt and unemployment insurance fee related to legal entities and individual entrepreneurs from the State Tax Service under the Ministry of Economy of the Republic of Azerbaijan.

In addition, detailed information was provided on the implementation status of the proposals received from the partners during the past year, ideas were exchanged regarding the projects implemented and planned to improve the ACB system and increase the quality of the provided services.

The Azerbaijan Credit Bureau collects, analyzes and submits the information of individuals and legal entities to credit organizations integrated into ACB upon request in order to evaluate their potential customers, monitor the behavior of existing customers, as well as minimize their risks by providing the most up-to-date solutions related to credit portfolio management. plays an important role. Currently, the number of partners of ACB has reached 240.

Taking into account the above, in 2023, ABA collected the opinions and proposals of banks in order to expand the range of services provided by ACB, as well as to increase the functionality of its system, and presented them to ACB.

It should be noted that the Azerbaijan Banks Association (ABA) was founded in 1990 by commercial banks. The main purpose of ABA is to protect the interests of member-organizations, to provide assistance in meeting their needs for various types of business services, and to coordinate their activities. Currently, 23 banks and 6 non-bank credit institutions are members of ABA.